Market Outlook and Investment Strategies in 2H 2022

Introduction

It was a disappointing 1H 2022. Several regions have suffered from different economic risks. While the US was suffering from surging inflation, the EMEA region was also facing soaring energy prices due to geopolitical tension between Russia and Ukraine. Economic Recession has always been the buzzword during the first half of 2022. In the meantime, COVID-related factors have also brought significant disruption to several markets, with China suffering the most in Q2. With the skyrocketing number of confirmed cases, the disruption of one of the largest manufacturing hubs around the globe has therefore led to a global supply chain crisis. Though China’s PMI and GDP growth both dwindled, it is recovering steadily with the ease of the Zero-COVID policy and pro-growth policies. Most assets have underperformed. Commodities were once the only asset that obtained positive returns among all the asset classes. Investors have lost their confidence in the equity market. IPO deals in Hong Kong and China have slumped in 1H 2022; On the other hand, fixed income products also received significant negative returns due to rate hikes in the US.

Answers to several questions are still unknown. The Fed’s attitude towards the skyrocketing inflation, the domino effect of the Zero-COVID policy, or the end of geopolitical tension remained uncertain. All of them contributed to the same question: Is recession the inevitable corollary in 2H22 and how should we react?

Global Investment Outlook in 2H 2022

China could be the first country to recover from a recession after escaping from COVID-related factors, and there could be a scenario of “First In First Out” (FIFO). China is deteriorating, Europe is at the border, while other countries such as the UK, US, and Japan are still above the recession trend. Thereby, as China first got into COVID, got out of COVID, and stepped into a downturn, China and Hong Kong could be the regions that rebound from the global recession the earliest. The PMI of China also rebounds with new home sales, signalling a possible relief from the projected downturn.

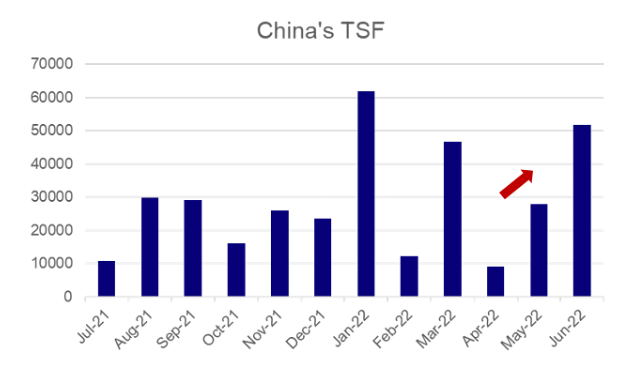

In June, there was a solid rebound in China as pandemic restrictions eased. Cities have reopened and economic activity is improving. Though there are increases in infection rates, China’s COVID policy has evolved. Smaller areas could be locked down in the event of a rise in infections instead of larger geographical areas. This policy enables policymakers to react quickly to any increase in infections. In addition, although China's household consumption remains weak, a recovery could still be led by industrial production and infrastructure investments due to pro-growth policies. China's Total Social Financing (TSF) has grown significantly in the past few months as the central bank encourages credit creation. The issuance of local government bonds and aggregate credit growth also acts as a stimulus to market sentiment.

Exhibit 1: China’s Total Social Financing (TSF) Volume (Source: Trading Economics)

Investors also expect a higher rate hike around the globe, as CPI just reached a record high of 9.1%. Since the Fed has just announced a 75bps increase with US GDP falling 0.9% in 2Q, the economic performance for developed markets remains negative in 2H. Hence, interest rate volatility remains the market mover, and the Fed policy direction will not end until inflation comes down. Developed market stocks may face a headwind from valuation followed by lower earnings growth.

As most Asian markets (emerging markets such as Indonesia, Thailand, and Malaysia) are sensitive to US financial conditions, investors should still be aware of the potential risks in investing in emerging markets. Relatively, Japanese stocks remain more attractive than local bonds and Asian stocks, though its economy is also facing a potential downturn due to the depreciation of the Yen.

Asset Allocation and Investment Strategies

Equities have suffered in 1H 2022. However, even though China and Hong Kong were the worst performing markets in 2021, they outperformed other markets in 2022 with a lower negative return. They also have relatively cheap valuations. With the monetary and fiscal support policy implemented by the central government, more assets should then be allocated to China and Hong Kong for risk diversification. The Healthcare and Construction Machinery sector could provide a potential investment opportunity. There are both short-term and long-term catalysts for customers to add China & Asia exposure, especially when the US and Europe are suffering from inflationary risks and possible recession. Though the valuations of US and EMEA equities have come down slightly, investors should remain conservative until the uncertainties are cleared.

On the other hand, fixed income has also suffered, as the hike in rates has led to a dwindle in prices and hence loss in portfolio returns. Though the performance of fixed income products has improved, investors should remain neutral, as the market volatility level remains high due to the potential interest rate hikes in 2H 2022. Government bonds will be a suitable option for fixed income investors. Moreover, to diversify investment risks, investors should as hold a certain amount of cash as a cushion.

Conclusion

To conclude, it is believed that the market will remain volatile in 2H22. With the recent release of economic data, the US has reported a consecutive negative growth of 0.9% in GDP, while the Fed has continued to raise rates. The possibility of economic recession has sparked a fierce debate within the financial sector, and investors should thereby remain conservative. Though the worst for several markets such as China and Hong Kong seems to be over, we should still be aware of the performance of other volatile markets, especially the US and the Eurozone.