Historical Financial Crises

A financial crisis is denoted as a situation where financial assets experience a significant drop in nominal value (often in a relatively short space of time). [1] This does not necessarily cause a recession, but it often does; these recessions also tend to spread well beyond the financial services sector. The most recent one would be the 2008 global financial crisis, which was triggered by subprime mortgages and the collapse in the U.S. housing market [2]. Whilst it is imprinted in many of our minds as being extremely severe and extraordinary, a quick whistle-stop tour of prior financial crises may prove it to be quite the opposite.

Crisis of 1772-73

Financial crises have been a part of our economy for at least the past five centuries, with public debt defaults originally being the main factor – sovereign debt crises. Since the creation of the NYSE (New York Stock & Exchange Board) stock exchange in 1792, financial crises have involved both public and private debt default, with wider definitions of financial crises even including currency and inflation issues. [3]

The crisis of 1772-73 originated in London and spread to mainland Europe and North America (still colonies at the time). It was due to a banker shorting a large amount of stock (the East India Company stock, a relatively large company at the time) and losing money as a result. This led to the firm failing and lowering confidence in banks, resulting in multiple bank runs. For an economy already highly dependent on credit at the time, this threatened the entire structure of the economy, forcing the Bank of England to bail out certain affected banks. They also had to provide favourable conditions in the form of increased liquidity and credit to other banks to keep them afloat. [4,5]

Crisis of 1791

The first publicly owned central bank in the US, the BUS (First Bank of the United States) was officially in operation from late 1791. It offered 80% of its shares to the public but still required a percentage to be paid in federal bonds. This created demand for federal bonds, which led to certain economic agents profiting from this demand by increasing public and bank borrowing. BUS was the largest of its kind at the time and made almost $2.7mn (around $73mn in today’s dollars [6]) worth of loans in its first two months alone. Its credit eventually started running low and BUS was forced into tightening credit a few months into operations, which stopped the flow of credit to those profiteering (who at this point were using new loans to pay off old loans, as they saw an opportunity to further maximise their profits); combined, this caused confidence in the market to plummet. This led to a sharp fall in the price of government debt and BUS shares (which had seen an increase of over 12x prior to this) and essentially a run on the bank. The resultant fallout had devastating effects, as it led to firms failing across various industries. It was resolved with a bailout from the state.

Panic of 1825

In 1825, there was yet another crisis in Britain. Following a couple of years of strong economic growth, bond interest rates were falling, leading to lower returns for investors. This spurred investors to look elsewhere, namely at the exciting ‘new world’. On top of bonds issued by these countries, there were numerous British mining companies set up to profit from the South American countries being explored by the Spanish. However, due to the duration of the expeditions and the lack of clear communication channels available at the time, information tended to be inaccurate; to the extent of companies being set up to mine in countries which did not exist, to begin with. There were further issues with investors overestimating the ability of these countries to repay any debts and wrongly expecting the British government to back these finances. This led to huge issues in terms of expected returns not being realised and investors losing money and bank runs. The Bank of England once again bailed out the banks and implemented further regulation on transparency for investors (albeit far from the standards we are familiar with today) and the size of banks (under the argument that larger banks would have had sufficient capital to weather the storm). This has in part helped pave the way for the larger banks that exist and dominate the retail banking sector in the UK today; which in itself could now be considered to be a regulatory risk as it may in fact hinder competition and provide suboptimal customer outcomes.

The Great Depression

The Great Depression of the 1930s was attributed to a few main causes, which included a speculative bubble in the stock market, where many investors had also invested on the margin (i.e. with money they did not have). Further runs on the bank were rife as retail customers feared for the safety of their money. The recession was also exacerbated by contractionary monetary policy in the form of increased rates to supposedly maintain the gold standard. A decrease in lending by American banks to foreign countries also fell as a result of increased interest rates, coupled with the imposition of tariffs led to a decline in foreign trade as well. Foreign governments in places such as Europe also raised interest rates to maintain trade balances, thereby reducing economic activity as well.[7] The world economy recovered as a result of various factors including reductions in taxes and regulation at the end of World War II.

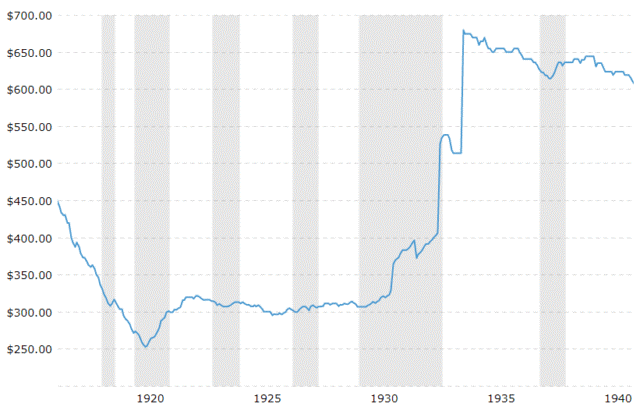

There are seemingly clear parallels with the 2008 financial crisis; in terms of a run on the bank and banks being bailed out by the government. However, each of these crises was unique, in terms of resulting winners and losers. A look into both the Great Depression and the 2008 financial crisis highlights this. During the Great Depression, gold was one of the first to rebound in price due to government price fixes at the time [8]. Whilst other commodities and the overall stock market did eventually regain their previous highs, certain stocks enjoyed extremely high returns [9]. These were concentrated in the defence, energy, and technology industries, as these played a vital role in America’s WW2 efforts. Similar, in 2008, there were individuals who made billions of dollars from shorting subprime mortgages, which were rendered essentially worthless once the full economic impact was felt.

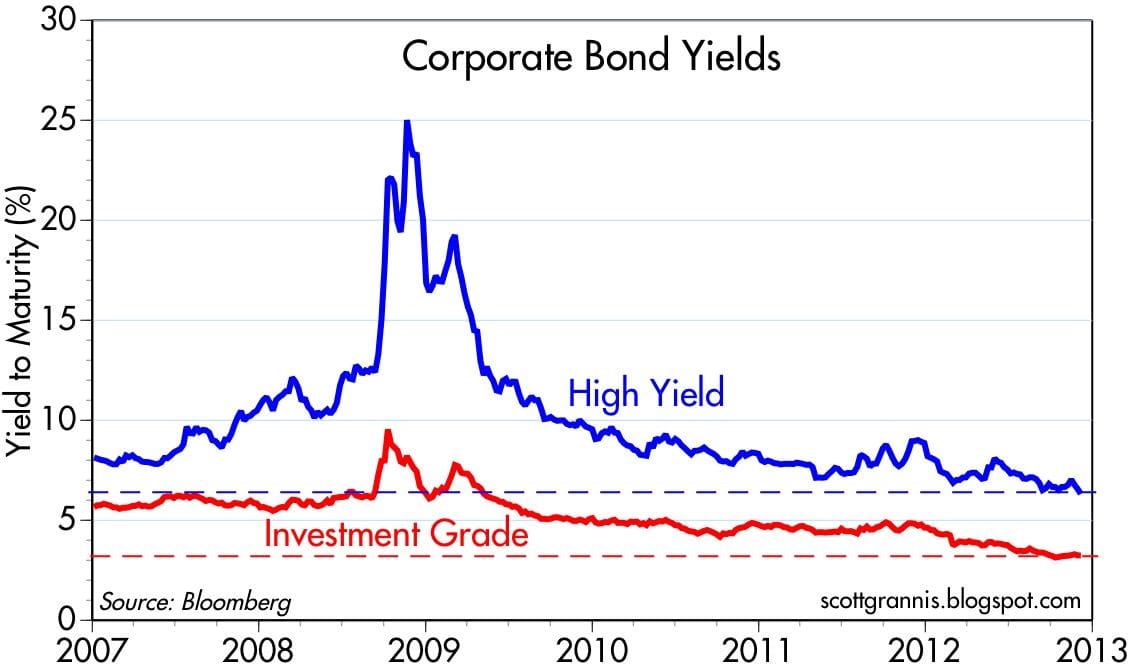

Furthermore, commodities tend to be considered safe havens from equity markets during recessions and therefore, experience higher prices and capital gains in those periods [10]. However, whilst assets such as Real Estate, an alternative asset class that provides diversification in an investment portfolio by not following traditional business cycles and the stock market so closely, did well during the Great Depression, they were hit relatively hard in 2008 as a result of the housing crisis.[11] Bonds also did relatively well whilst stocks suffered in the Great Depression. This trend continued for government bonds in the 2008 financial crash, but not so much for high yield corporate bonds, as investors were increasingly worried about default. Therefore, this demonstrates that while various assets do provide protection against adverse market conditions affecting certain assets, the extent to which it does so varies depending on external factors and the underlying reasons behind the recession. Another thing to note is the timing of various asset classes benefitting from a recession, with recoveries in some assets being more pronounced earlier on than others, such as bonds recovering before gold in the Great Depression. This is clear from the graphs below. [12,13,14]

Other Notable Crises

Latin American Debt Crisis

The Latin American Debt Crisis of the 1980s affected countries such as Brazil and Mexico. It was due to excessive borrowing in the 1970s, in an era of economic expansion for these developing nations. This culminated into debt levels reaching 50% of GDP in 1983, resulting in unsustainable borrowing. When the oil price rose in the late 1970s, the US raised interest rates to control inflation. Monetary policy tightened as the global economy fell into a recession. The resulting effect on South American debt was that it too became that much more expensive. [15] Combined with the slow down in growth caused by the knock-on effects of the global recession, some of these countries were forced to default and borrow money from the IMF-comparable with traditional bailing out by national banks. [16] The IMF did impose certain conditions on this borrowing though, including some on privatisation and the removal of tariff barriers. While this should have created further opportunity in the form of future economic growth and in certain sectors, there were issues with the way the guidelines were adhered to and changes implemented that prolonged the period of low growth. [17]

Asian Financial Crisis

The Asian financial crisis of 1997 on the other hand, came about from a plethora of different reasons. Strong economic growth in Asian economies such as Thailand, South Korea and Malaysia in the years leading up to the crisis had attracted hot money flows to the region. However, when U.S. interest rates started picking up, hot money flows started decreasing, putting downward pressure on these currencies, which were often pegged. This then started a cycle of speculative attacks, which led to rapid currency devaluations and debt defaults. On top of this, IMF intervention led to contractionary fiscal policy, reducing investor confidence further and deepening the impending recession. Investors who bet against some of these currencies, namely the Thai Baht and the Malaysian Ringgit, managed to profit from these situations as a result of the currency devaluations. [18,19,20,21]

[1] https://www.investopedia.com/terms/f/financial-crisis.asp

[2] https://www.britannica.com/event/financial-crisis-of-2007-2008

[3] https://www.britannica.com/list/5-of-the-worlds-most-devastating-financial-crises

[6] https://www.officialdata.org/us/inflation/1792?amount=2.70

[7] https://www.britannica.com/story/causes-of-the-great-depression

[8] https://seekingalpha.com/article/4354223-gold-prices-during-great-depression

[9] https://thehustle.co/top-performing-great-depression-stocks/

[10] https://budgeting.thenest.com/good-assets-own-depression-23838.html

[11] https://www.marketplace.org/2008/09/30/investing-during-great-depression/

[13] https://newworldeconomics.com/the-federal-reserve-in-the-1930s-2-interest-rates/

[14] http://scottgrannis.blogspot.com/2012/12/corporate-bonds-are-moderately.html

[15] https://www.stlouisfed.org/publications/regional-economist/january-2015/sovereign-debt-crisis

[16] https://www.economicshelp.org/blog/glossary/debt-crisis-latin-america/

[17] https://www.federalreservehistory.org/essays/latin_american_debt_crisis

[18] https://www.economicshelp.org/blog/glossary/financial-crisis-asia-1997/

[19] https://www.imf.org/external/pubs/ft/fandd/1998/06/imfstaff.htm

[20] https://www.investopedia.com/articles/investing/090815/3-best-investments-george-soros-ever-made.asp

[21] https://www.businessinsider.com/how-george-soros-broke-the-bank-of-thailand-2016-9?r=US&IR=T