Green Policy – Top of the Agenda for European Markets

“I want to explore every avenue available in order to combat climate change” – Christine Lagarde

The following statement from the President of the European Central Bank in a recent video interview with the Financial Times shows us that the massive shift towards green policy initiatives has not been postponed due to COVID-19. In this article, I’ll be exploring the green policy changes that have been proposed and why we can expect an outperformance in ESG funds, Automotive Sector and Energy Sector.

During the interview, it was mentioned that the ECB may look to use the $2.8tn asset purchase scheme to pursue green objectives. [1] Currently, 5% of the holdings from Corporate Sector Purchase Programme (CSPP) and Pandemic Emergency Purchase Programme (PEPP) are corporate green bonds and the ECB have previously expressed an interest in increasing their holdings of Green and Sustainable bonds.

Green bonds are a type of fixed income instrument which holds the specific purpose of raising money for new or existing projects that help reach environmental goals. [4] Sustainable bonds are those which combine both green and social projects such as combating hunger and food security. According to the Climate Bonds Initiative, green bond issuance is expected to reach US$350 billion this year which would be a 36% increase from 2019. The following chart from DZ Bank shows predictions for the market issuance volume of green bonds to reach US$500 billion this year and US$1.5 trillion by 2023. [3]

ESG Funds

Demand is ever increasing for these bonds as green policies shift investor sentiment towards sustainable initiatives and environmentalists’ increased pressure to reduce “brown” bonds which are issued by carbon intensive companies. [1] However, due to the non-financial return aspect of this asset, there are strict guidelines and detailed reporting requirements for these projects. [4] This subsequently dampens the increase in supply relative to demand as many bonds do not meet the ESG worthy investment criteria. [10] As a result, in the scenario that the ECB’s Asset Purchase Program is used to invest in green bonds, there is a strong possibility that we will see an inflow of excess demand driving up prices and triggering a sustained bull market rally.

In addition, we can expect a positive effect on the performance of ESG mutual funds due to increased inflows from investors to capitalise on this trend. Research from Morningstar indicates this pattern as “sustainable funds also outpaced traditional funds during the market sell-off sparked by coronavirus in the first quarter, notching up average excess returns of up to 1.83 per cent”. [2] They also discovered that ESG funds from 10 years ago had a survivorship rate of 77% compared to 46% for traditional funds so we can expect ESG titled indexes to consistently outperform in the following months as the ECB catalyses this trend.

The question should also be raised of how the green recovery plan is being implemented across different countries. Now we will evaluate the actions of some EU National Governments listed below and the potential impact on the Automotive and Energy Sectors.

Automotive Sector

Data collected by the ACEA (European Automotive Manufacturers Association) shows that after the first wave of the virus, between mid-March and May, the EU market contracted by 41.5% and car sales were down by more than 95% in major EU markets in May. [6] Since 13.8 million Europeans work in this industry and 11.4% of all EU manufacturing jobs are in the automotive sector, there will be definitely be targeted economic support to limit unemployment levels over the next quarter.

“As we work on putting the wheels back in motion, we must look for win-win solutions, addressing the pressing environmental, industrial and broader societal needs,” – Sigrid de Vries, CLEPA Secretary General.

On 14th May, the European Commission held a meeting with Automotive CEO’s and expressed that the purpose of automotive recovery measures will target investments in renewable energy carriers and infrastructure to boost industry growth through technology solutions. [5] As a result, fiscal measures in the form of tax benefits or purchase incentives for buyers have been implemented in 26/27 EU countries to stimulate electric vehicle sales with the exception of Lithuania. [7] Furthermore, out of the € 42 billion allocated to Germany’s green projects, around 22% will be allocated towards the automotive sector with €2.5bn used to expand Germany’s charging infrastructure for electric cars. The French car industry will receive a similar aid package of around €8bn which will be invested heavily in Renault for electromobility. [9] Based on the strong push from EU policies to accelerate the secular trend towards electric vehicles through supply chain innovation and sustainable growth within this sector, the automotive market is due for a strong recovery towards the end of this year.

Energy Sector

On 11th December 2019, the European Green Deal was published with the overarching aim for Europe to become ‘Climate Neutral’ and reach net-zero greenhouse gas emissions by 2050. This initiative was reinforced with the recent Next Generation EU proposal to add €750bn to the European budget with aim to

“kick-start the European economy, boost the green and digital transitions, and make it fairer, more resilient and more sustainable for future generations”.

Since then, Germany has allocated €11bn to subsidise renewable energy in 2021 and 2022 and €7bn to the development of a hydrogen strategy for industrial usage. France has also directed €7bn of support to Air France with the condition that the “company should reduce its Co2 emissions by 50% by 2024 for domestic flights, it should renew its fleet with more efficient aircraft and use more biofuel”. [9] The Dutch government was planning to reduce Co2 emissions by 49% by 2030 compared to 1990 through carbon taxes for large companies but those have been loosened due to the crisis and their focus is now on increasing green investment policies for financial institutions.

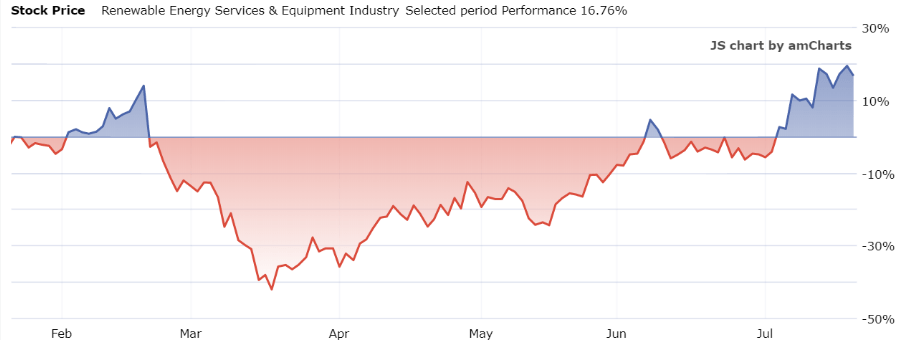

CSI Market Renewable Energy Services & Equipment Sector 6M Performance on 21/07/19

All these initiatives are focused towards increasing the availability and production of renewable energy sources and cleaner fuels will slowly become the new normal. The chart data from CSI Market highlights this megatrend as there is a significant and consistent outperformance from the Renewable Energy subsector. [8] The impact of this industry shift is highlighted by the drastic measures taken by major energy companies BP, Shell, Total and Repsol to lower their price assumptions and net zero commitment expectations driving their decisions. [11]

From the analysis above, we can see that the Green policy is definitely expected to stay at the top of the agenda and contrary to former concerns that COVID-19 would hinder this process, there has actually been an acceleration in secular innovation for Electric vehicles, Cleaner fuels and sustainable growth of ESG.

What’s Next on the Agenda for a Green Transition?

Although the green issuance started from only US$2.6 billion in 2012 and is now predicted to reach US$500 billion by the end of 2020, there are many ethical and regulatory considerations which could potentially hinder growth prospects over the coming decade. In order to boost investor confidence in Green bonds on a larger scale, here are two key issues that will need to be addressed.

- “Green washing” – this is the practice of falsely claiming a green status without adhering to the guidelines published by the International Capital Market Association (ICMA) and the Climate Bonds Standards of the Climate Bonds Initiative (CBI). [12] These institutions are the most commonly accepted accreditors but for a business to gain ‘green’ certification, the issuer is allowed to pick a certifier of choice; this demands a second opinion. The absence of an international governing body for new investment products has become a massive red flag in the industry since the Subprime Mortgage Crisis in 2008. Hence, until the independent creditworthiness of green bonds can be verified under stringent conditions, we are unlikely to see the market boom.

- Misaligned objectives – Due to the ambiguity in definition of a green bond, unlike many other financial products, there is little evidence of whether a quantifiable change will be made. Ideally, each stage of the green project from distribution of net funds to operational expenses should be reported in advance but this raises costs as large amounts of empirical data analysis are required. Hence, the trade-off between higher transparency costs and ROI may become unfavorable and stop future investments in green bonds. In addition, the monitoring of finances gained out of issuance is equally as important; an example of a conflict arising from this was Woolworth Group’s AU$400 capital raise through green bond issuance for low-carbon supermarket development. Their proposition was to provide project renovations such as energy-efficient LED lighting within stores but this would also be implemented across their investments in gambling and liquor businesses. [12] The moral debate of whether it is truly an ESG initiative if it also helps to promote alcohol and gambling proved to discourage investors. This case study is highly relevant because Chief Executive, Sean Kidney stated that under the Paris agreement, 40 per cent of carbon emission reductions must come from improving the built environment. Due to their high demand, renovation project authorization will need high ethical standards and trusted third party governance to gain investment credibility.