An Introduction To Hedge Funds

In 1949, Alfred Winslow Jones set up the first-ever hedge fund. Despite being referred to as ‘the father of the hedge fund industry’, Jones did not spend his career working at big financial institutions [1]. In the 1930s, Jones worked at the U.S. embassy in Berlin during Hitler’s rise to power. Later, Jones spent his honeymoon hiking and reporting on the front lines of the Spanish civil war, meeting with Dorothy Parker and sharing a bottle of scotch whisky with Ernest Hemingway [2]. In 1949, at the age of 48, Jones assembled $100,000 to set up the first-ever hedge fund. With its innovative investment strategy, Jones was able to generate extraordinary profits throughout the 1950s and 1960s. Since then, many hedge funds have been set up and have enjoyed similar levels of financial success.

What Is a Hedge Fund?

Hedge funds trade assets in the financial markets. More specifically, a hedge fund gathers money from its clients and invests this into the financial markets. A hedge fund may choose to invest in a variety of asset classes such as stocks, bonds, or derivatives. In general, hedge funds are rather diverse in structure, and investment strategies may vary between firms.

Nevertheless, the main aim of all hedge funds is to generate alpha for their investors – meaning they try to generate investment returns that outperform the market. In order to achieve alpha, hedge funds are often more actively or aggressively managed than other types of funds. By doing so, hedge funds aim to generate some of the highest returns on investments that can be seen in the financial markets.

What Makes Hedge Funds Different to Other Types of Firms?

One aspect that distinguishes hedge funds from other investment firms is the level of risk that they undertake. Hedge funds often make riskier investment decisions, especially when compared to other players in the financial markets. The riskier investments made by hedge funds can lead to very large returns on investment if things go well. However, if a risky investment backfires, then huge losses could be incurred.

Hedge funds typically use riskier and more complex trading methods in comparison to other investment vehicles [3]. For example, hedge funds may rely heavily on leverage (investing using borrowed capital), derivatives (investing in contracts for which the value is reliant upon an underlying asset), and short selling (selling an asset with the aim of buying it back later at a lower price).

Due to the volatile and risky nature of hedge funds, there are regulations that restrict who can invest in hedge funds. Hedge funds can only work with clients who are considered ‘accredited investors’ [4]. These typically include institutional investors, recognised companies, and high net worth individuals. Thus, financial regulations mean that hedge funds are predominantly unavailable to retail investors and the public alike.

How Are Hedge Funds Regulated?

The reason why hedge funds can make much more risky investment decisions is that they face less regulation in comparison to other investment vehicles. This is because hedge funds may only take money from accredited investors. More specifically, hedge funds are restricted under the Securities Act of 1933, which states that hedge funds may only raise capital via non-public offerings and only from accredited investors or individuals with a minimum net worth of $1,000,000 (i.e. high-net-worth individuals) [5]. That being said, hedge funds must still adhere to the same trade reporting requirements as others investing in publicly traded securities.

How Do Hedge Funds Invest Their Money?

One particularly prominent technique used by hedge funds is investing through leverage. Leverage refers to any technique where debt (borrowed funds) is used rather than equity in the purchase of an asset. Essentially, a hedge fund may borrow money in the form of a loan so that they can invest larger amounts of money than they could otherwise have done with just their clients’ funds. By investing larger sums of money, hedge funds can maximise returns on investments and generate significantly larger profits by using leverage.

For example, suppose a hedge fund assembles £1 million from their clients. The hedge fund may also take out a loan of £1 million, meaning their total investment equates to £2 million. If their investment grows by 25% after a certain period of time, then their investment will be worth £2.5 million. Ignoring the costs of borrowing money (such as paying interest), the hedge fund will have grown its investment by £500 million. This is double what their return would have been having not used leverage. Hence, it is hopefully clear how leverage can be used to multiply returns on investment.

Figure 1: Financial leverage is typically defined as the ratio between debt and equity. Hedge funds often use high levels of leverage when investing.

In practice, the leverage ratio used by hedge funds (that is, how much leverage a company takes on in comparison to how much equity they invest with) can be quite large. In the previous example, the leverage ratio was 1, as the hedge fund had £1 million in equity and £1 million in debt. However, hedge funds may use leverage that is anywhere between 2 and 10 times the value of equity. Such a reliance on leverage can mean that if investments underperform, then a hedge fund may be liable to defaulting on their loans. For example, Long-Term Capital Management was a large UK hedge fund that collapsed in 1998, largely due to its reported leverage ratio of 25 [6].

Another prominent technique used by hedge funds is known as short selling. This is when an investor borrows a stock and then sells the stock with the intention of buying it back at a later date when returning the stock to the lender [7]. This has been illustrated in the figure below.

Short sellers are effectively betting that the price of a given stock will decrease and they aim to take advantage of this by re-purchasing the stock at a lower price than they originally bought it for. Of course, things can get bad for hedge funds if this bet on the market backfires. Recently, short selling by hedge funds has been put into the limelight after retail investors recently purchased a large number of GameStop stocks, which caused the stock price to rise significantly. Some hedge funds had been short selling GameStop stocks and so the rise in price meant hedge funds could not re-purchase the stocks at the anticipated lower prices [9]. Some hedge funds have lost hundreds of millions as a result [10]. In total, short sellers who bet against GameStop stocks have lost $3.3 billion, according to S3 Partners [11].

How Do Hedge Funds Charge Their Clients?

A hedge fund will typically charge a client in two forms: a management fee and a performance fee. A management fee is simply a charge based on the value of any funds managed by the hedge fund. The performance fee is an additional charge that is included if the hedge fund achieves a particular level of return on investment.

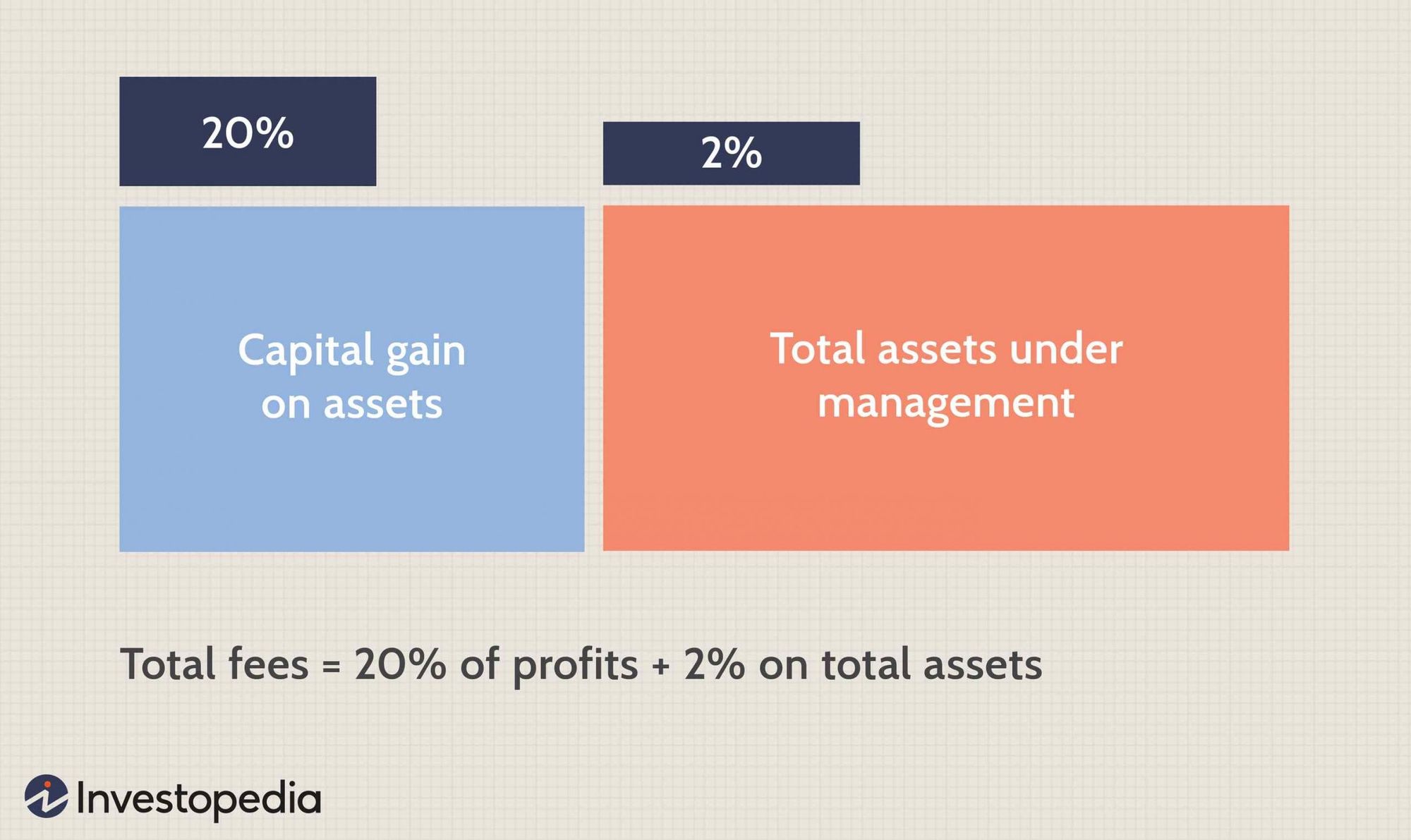

Hedge funds often use a fee structure known as ‘two and twenty’. This fee arrangement is standard in the hedge fund industry as well as in venture capital and private equity. The two and twenty fee structure is as follows. Hedge funds typically charge a management fee of 2%, meaning they charge a fee equal to 2% of the total assets under management in a fund. Hedge funds may then charge a performance fee of 20%, meaning they keep 20% of profits if investments reach a previously agreed benchmark. The two and twenty fee structure used by hedge funds is illustrated in the figure below.

Performance fees are often seen as a way of providing incentives for hedge funds to actively manage funds in order to get the best return possible (as they will receive a percentage of these returns via the performance fee). This fee arrangement has indeed resulted in many hedge fund managers making huge profits for themselves, sometimes earning millions from each investment. This has led to greater scrutiny from investors, politicians, and regulators in recent years. Given the recent news involving hedge funds and GameStop, scrutiny upon hedge funds is likely to grow.

References

[1] Johnson, S. (2007). A Short History of Bankruptcy, Death, Suicides, and Fortunes. Fortune Magazine. Archived by Financial Times, 2009.

[2] Mallaby, S. (2010). More Money Than God. Penguin Group.

[4] https://www.investopedia.com/articles/investing/102113/what-are-hedge-funds.asp

[5] https://www.cfainstitute.org/en/advocacy/issues/hedge-funds

[6] Lowenstein, R.(2000). When Genius Failed: The Rise and Fall of Long-Term Capital Management. Random House Trade Paperbacks. p. 95-97.

[7] https://www.investopedia.com/terms/s/shortselling.asp

[8] https://www.thebalance.com/the-basics-of-shorting-stock-356327

[9] https://www.ft.com/content/f2929fcc-cc62-4d20-8397-2040ce3f595e

[12] https://www.investopedia.com/terms/t/two_and_twenty.asp